Firehose #187: 🌊 A new marketplace wave. 🌊

Wholesale marketplaces are coming. Here are 3 strategies to help them succeed.

One Big Thought

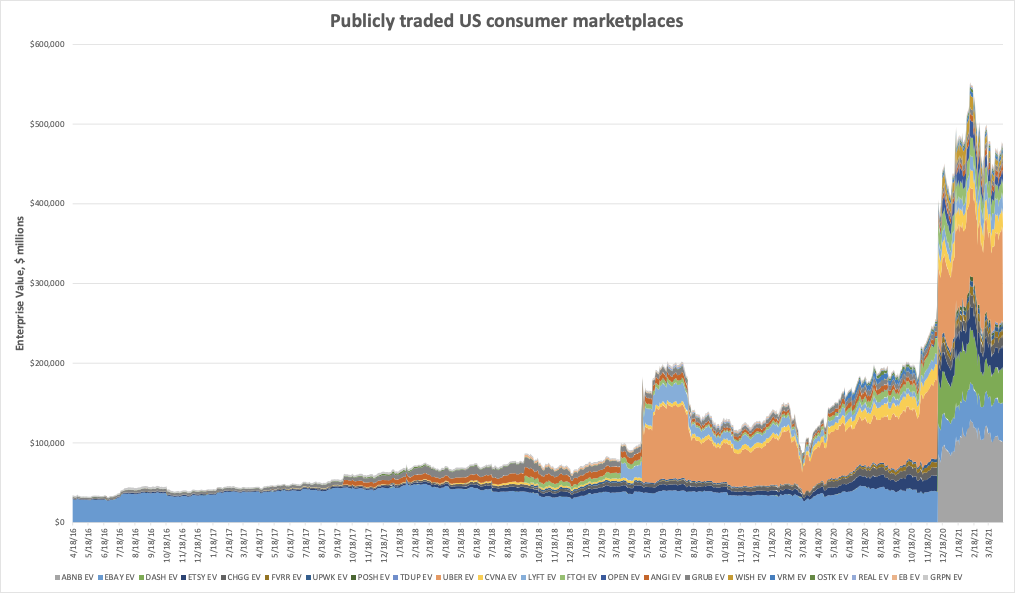

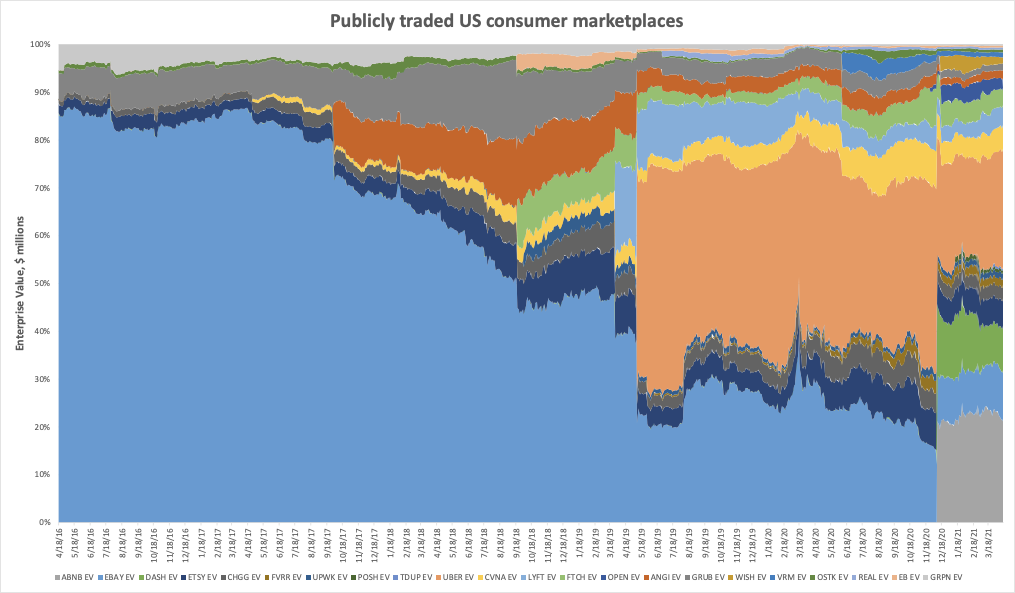

Consumer marketplaces in the US have exploded in value over the last 5 years.

Of the publicly traded, independent US marketplaces that exist today, only 6 were public companies in April 2016 — EBAY ($30B), GRUB ($1.8B), GRPN ($1.8B), ETSY ($715M), CHGG ($321M) and OSTK ($234M). These companies were worth a combined $34B, 88% of which was EBAY — a company that was already 20 years old back then.

Since then, the public markets have embraced 16 new consumer marketplaces ranging from travel (ABNB*), logistics (DASH, UBER, LYFT), apparel (POSH, REAL, TDUP*, FTCH), real estate (OPEN), e-commerce (WISH), automotive (CVNA, VRM), events (EB), and services (ANGI, FVRR, UPWK). EBAY has shrunk from 88% of aggregate marketplace enterprise value to only 10% today. Aggregate enterprise value has exploded to $474B across these 22 listed companies. Of the $440B of gain in enterprise value over the last 5 years, only 15% came from the original 6 stocks. These 16 new marketplaces have been responsible for nearly all the incremental value creation.

Consumers have been the prime beneficiaries of the marketplace model of innovation. Connecting fragmented populations of individual buyers and sellers has created a surplus of economic value for consumers, a fraction of which has been captured by the platforms themselves in the form of a take rate (ranging from 5-50%, depending on a variety of factors, but typically settling in the 10-20% range for most):

Offline buyers and sellers face all sorts of issues that an internet platform can solve: trust & safety, logistics, financing, etc. Solving these problems creates a wedge to disrupt incumbent middlemen like travel agents, auto dealers, real estate agents, ticket brokers, and department stores. While much of the low hanging fruit has been picked in consumer marketplaces, we still see new examples popping up, including in education (Outschool*), coaching (BetterUp*), and entertainment (Cameo*).

While nearly half a trillion in enterprise value created by US consumer marketplaces in the last 5 years, we may see an even greater wave over the next 5 years in wholesale marketplaces.

Wholesale value chains have similar problems. They lack price transparency, suffer from inefficient logistics, and struggle to collect and distribute payments on time. Furthermore, the dollar values are significantly higher and margins are often lower — which means that errors have significantly greater consequences. As such, many wholesale markets have built-in redundancy to deal with inefficiency and minimize risk.

The most challenging aspect of wholesale marketplaces is how you fight disintermediation. If two businesses continually work together, they will have low willingness to pay to a marketplace that connects them. Two consumers who want to coordinate an Uber ride (one in the other’s car) have few options to practically arrange a pick up. But, a grocery store might purchase bread from the same bakery it has been working with for years. At the end of the day, the owner can always pick up the phone and place an order the old fashioned way.

Creating a repeatable purchase pattern between two recurring buyers is therefore the main challenge and opportunity for a wholesale marketplace. Extracting a 10-20% take rate is only possible when each transaction has more value than the matching itself. Here are a few ideas that could help:

Take risk away. Trying new products is risky in a variety of ways for wholesale buyers. New products might not sell through. New vendors can have variable quality. A buyer might not have a liquidation channel to recapture value in the event an item does not sell. To solve this problem in its own business, Faire* guaranteed free returns on new brand orders and, over time, managed the risk itself as a feature of the platform. This innovation allowed retailers to shop without worry for new items and find new ways to grow their businesses. Because retailers want to maintain “freshness” of inventory, there’s a recurring need for new merchandise and, definitionally, these new brands are incremental to the platform.

Come for the logistics; stay for the network. Some wholesale industries are limited by delivery times and availability of product. Produce, chemicals, and construction materials are all industries where products must arrive when expected. Fruit can rot, chemicals can expire, and steel beams can miss their construction window. Providing more reliable logistics can be the reason that a buyer will reorder from the same vendor and still pay the required take rate.

Business-in-a-box. Since I wrote my original post on this topic in 2019, I’ve seen more examples of companies that are giving away vertical software for free to SMBs in order to insert themselves in the flow of payments and services. Many SMB sectors have some form of order management, point-of-sale, or other horizontal software. But few have software truly built for their own vertical. If you can build the system of record for an industry and make it freely available, SMBs will be inclined to order through your system as well.

If a wholesale marketplace solves the disintermediation problem, it can often generate multiple orders per month. Few consumer marketplaces can come close to this level of purchase frequency, so the success metrics for wholesale marketplaces tend to look much different. The north star metric I follow in wholesale is “share of wallet.” Often a wholesale marketplace will “land” a customer with a single SKU line that has high purchase frequency and low margin. The goal is then to “expand” through cross-sell into the other buying needs of that business — ideally the less frequent, high margin purchases. The marketplace can cross over into a very defensible position once the customer is purchasing a meaningful amount of their volume through the platform. I often see a share of wallet tipping point after which churn become negligible (other than a customer going out of business).

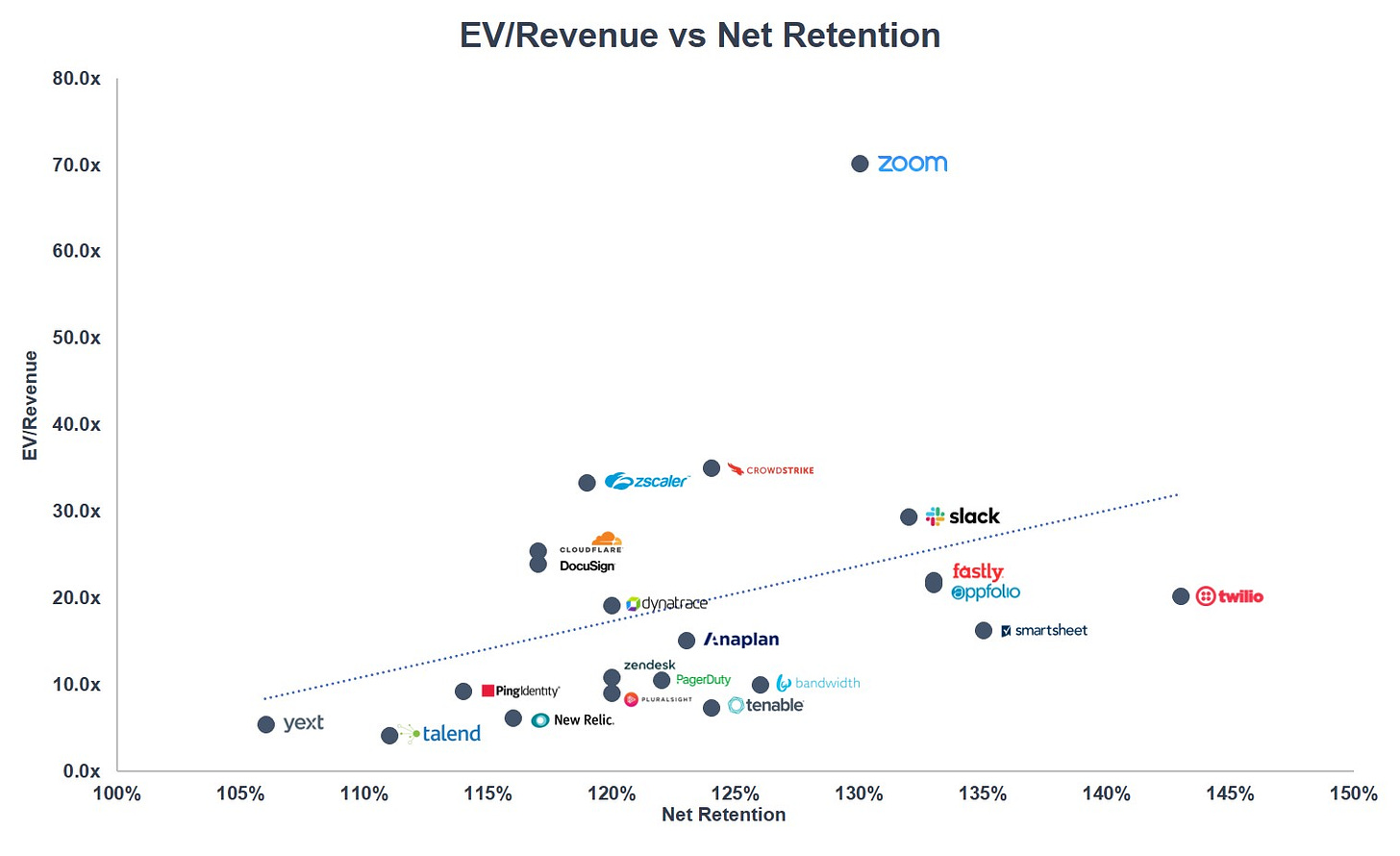

Dollar retention is therefore very strong for successful wholesale marketplaces. For SaaS companies, valuation multiples are strongly correlated with net dollar retention, and I expect wholesale marketplaces will exhibit the same dynamics as future public companies:

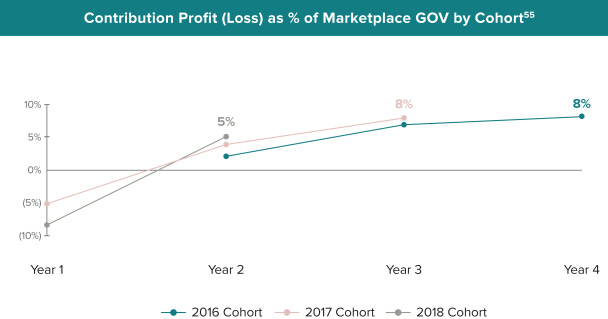

Increasing scale benefits these marketplaces on the customer acquisition side as well. As product catalogues grow, conversion rates go up. While cost of leads might go up over time, the increased conversion rate can provide a buffer to CAC and keep the unit economics of the business strong. We see similar effects in consumer marketplaces like DASH, which has been able to increase its LTV/CAC over time:

In short, consumer marketplaces have become relatively mature, but wholesale marketplaces are just getting started. I’m excited to meet more entrepreneurs building these businesses in the coming years and back more of them.

Tweet of the Week

Enjoyed this newsletter?

Getting Drinking from the Firehose in your inbox via Substack is easy. Click below to subscribe:

Have some thoughts? Leave me a comment:

Or share this post on social media to get the word out:

Disclaimer: * indicates a Lightspeed portfolio company, or other company in which I have economic interest. I also have economic interest in AAPL, ABNB, ADBE, AMT, AMZN, BABA, BRK, BLK, CCI, CRM, GOOG/GOOGL, FB, HD, LMT, MA, MCD, MSFT, NFLX, NSRGY, NEE, PYPL, SHOP, SNAP, SPOT, SQ, TDUP, TMO, TWLO, VEEV, and V.