Firehose #195: 🍲 The kitchen is open. 🍲

Announcing Lightspeed’s Series C investment in All Day Kitchens — the leading distributed platform for restaurant infrastructure.

Remember me?

A few months have passed since my last newsletter. Every now and then, I get into a pattern at work that so consumes my schedule that I don’t have time to sit down and write this newsletter each week.

I’m definitely in one of those patterns now. I can’t recall a time when I was busier. That said, I did announce a new investment this week in All Day Kitchens and wanted to share some of the thought behind it with all of you. I’d welcome your inquiries and feedback.

I hope to get back into more of a regular writing cadence before the end of 2021. Until then, Firehose is going to lean heavily on the “ish” in “weely(ish).”

One Big Thought

Local restaurants form the character of the communities they serve. Because food is the only we retail product we ingest, restaurants are deeply personal establishments. The late, great chef, author, and food culture documentarian Anthony Bourdain spoke eloquently on this topic:

Food is everything we are. It’s an extension of nationalist feeling, ethnic feeling, your personal history, your province, your region, your tribe, your grandma. It’s inseparable from those from the get-go. Even before we get into food professionals or food bloggers or food nerds, you’re already talking about something that people identify very closely with their identities.

A dark cloud and a silver lining.

The COVID-19 pandemic has wreaked havoc on public health and the global economy. Less discussed is pain it has inflicted on the social fabric of communities, of which restaurants are a critical part. When restaurants shut down, communities suffer too. From the beginning of the pandemic through the end of 2020, 17% of all US restaurants (over 100,000 establishments) closed their doors permanently. 16% of those restaurants had been open for more than 30 years. Local heroes like Pok Pok of Portland, Mission Chinese of NYC, Cliff House in SF, and City Tavern in Philadelphia were among the list of casualties.

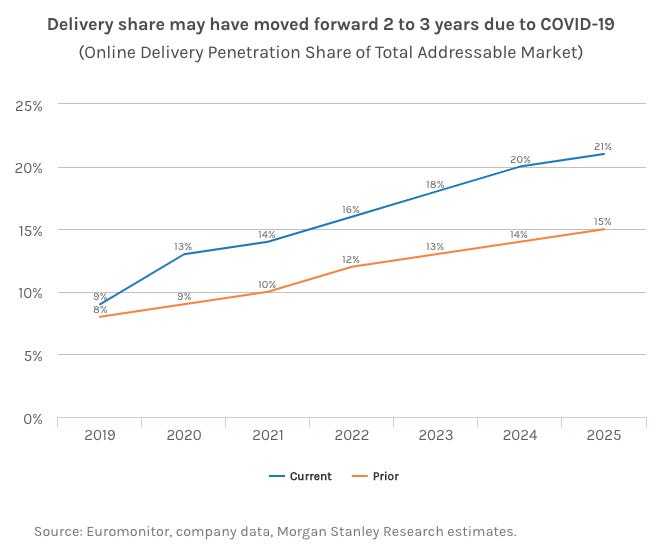

The silver lining during these dark times for restaurants has been a booming e-commerce business. Online delivery had admirably grown to 8% of US restaurant sales in 2019, but COVID-19 pulled its market penetration forward by 2–3 years, according to Morgan Stanley. We now expect 20–25% of the of the US restaurant industry ($900 billion at its peak) to be fulfilled through delivery by 2025, with 53% of Americans now saying that purchasing take-out or delivery is “essential to the way I live.”

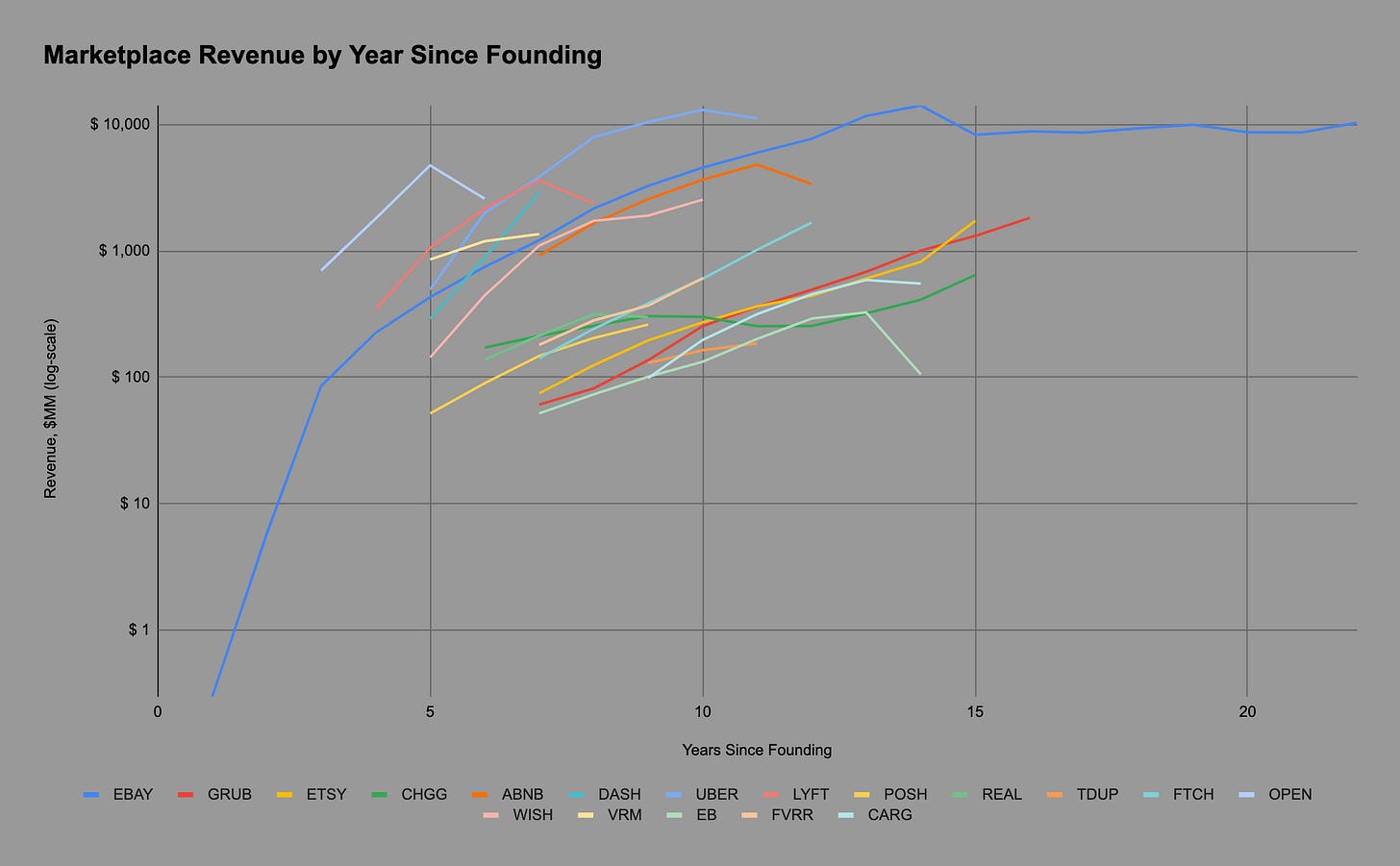

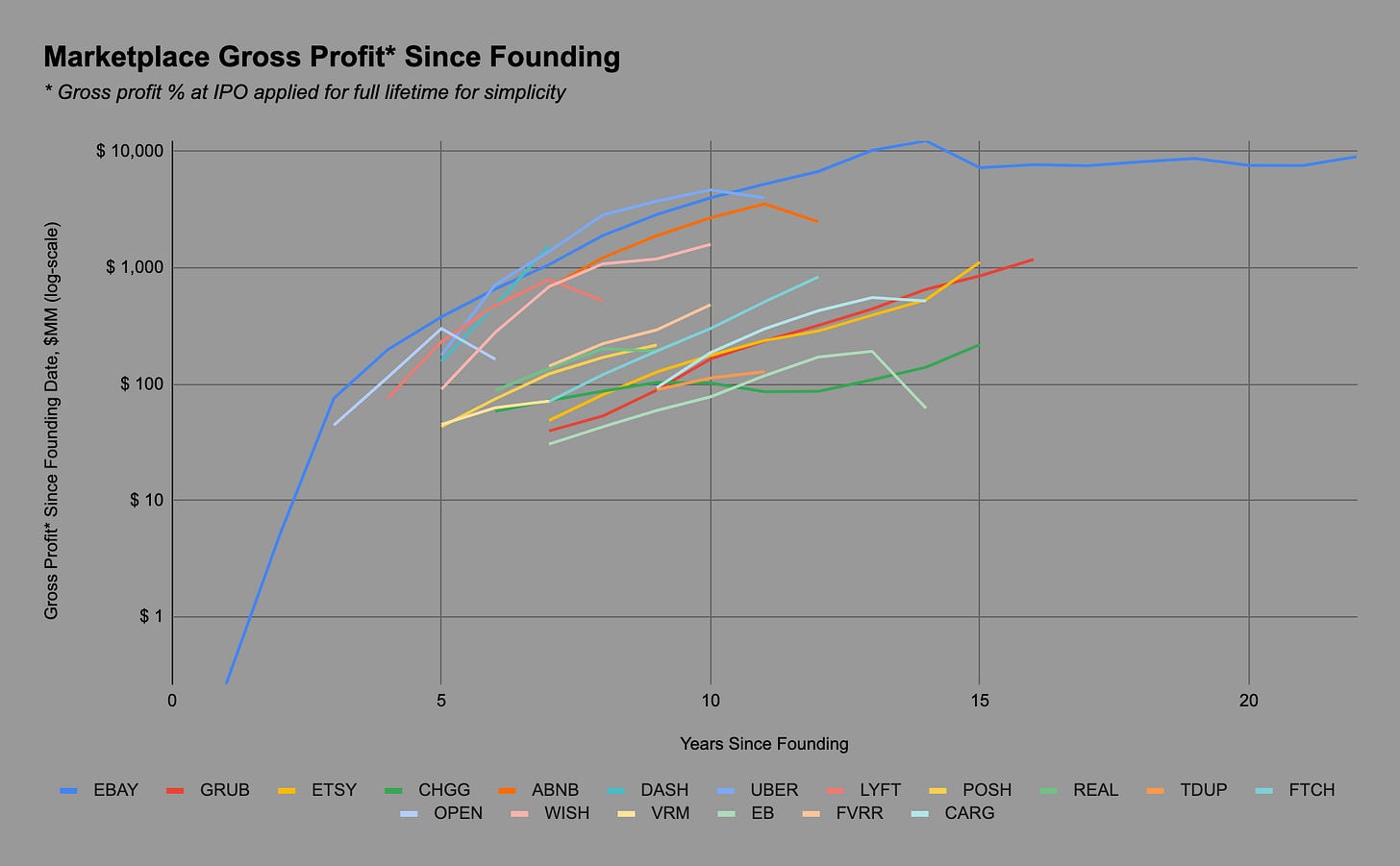

The demand-side of the food ordering equation would not be possible without delivery networks like Doordash (DASH, $74B), Uber Eats/Postmates (UBER, $89B), and more. Self-ordering is also possible thanks to Square (SQ, $121B), Toast (TOST, $28B), and other vendors who allow restaurants to manage those orders themselves. Middleware vendors like Olo (OLO, $5B) allow restaurants to connect those solutions into other systems of record, creating an omni-channel experience for restaurants.

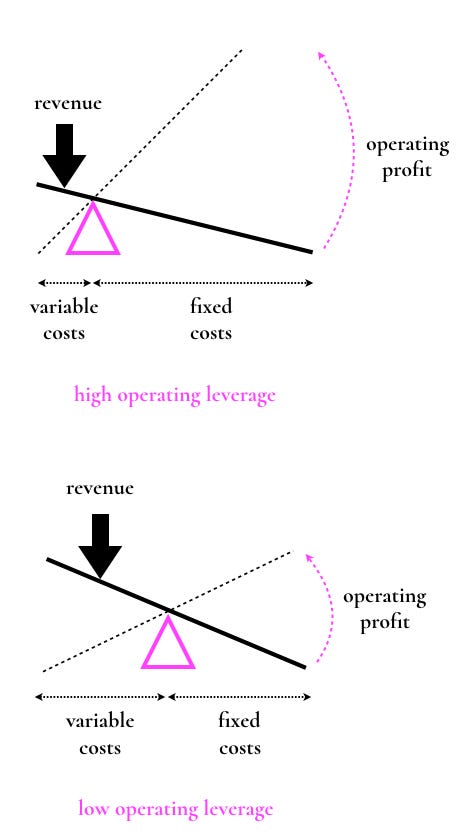

Yet, despite this new source of e-commerce demand, restaurants have struggled to keep up. The dominant reason is that restaurant demand is inherently “peaky.” It’s even more peaky now that delivery and pick up are turning restaurants into omni-channel retailers. Restaurants have fixed labor costs that do not scale up or down with volatile demand throughout the day and week. Kitchens also have operating constraints defined by physical space, in addition to staff levels. While some QSR chains like Chipotle and Wendy’s have built out their own large commissary kitchens to serve the mass market, the roughly half of the US restaurant market that is independently owned is not operationally set up to scale like internet businesses.

A scalable back-end for independent restaurants.

Ken Chong and Matt Sawchuk saw these problems first-hand during their time at Uber, where they helped grow Uber Eats’ GMV from $0 to $6B in GMV run-rate in only a few years. They understood that the critical bottleneck to the growth of delivery was the kitchen itself.

The duo left Uber to start All Day Kitchens to address this problem. Today, we’re announcing that Lightspeed is leading the company’s $65M Series C financing. I delighted to join the board on the firm’s behalf.

Ken and Matt quickly noted a few problems with the conventional “ghost kitchen” model. First, traditional warehouse kitchens require significant scale in real estate, so the cost per square foot needs to be much lower than a typical restaurant. Those spaces don’t typically exist near where people live. So delivery orders fulfilled by warehouse kitchens in cheap, industrial zones often take significant time to reach the end-customer — resulting in a poor customer experience. Second, restaurants do not want to manage additional staff in a warehouse kitchen in order to scale. They have enough trouble hiring line chefs at competitive rates and can only manage so much labor complexity in a small business. Third, each restaurant manages its own menu and assortment in a traditional warehouse model, working with a restricted menu to streamline operations. It therefore lacks the ability to cross-sell into a longer tail of products, and participating in multi-restaurant baskets is impossible.

All Day Kitchens was designed with a novel operational model in mind. Instead of large centralized warehouse kitchens, it operates a dense network of distributed small kitchens that sit in neighborhoods close to the customer.

Restaurants prepare food in their own kitchens during down time and ship product “nearly finished” into the All Day Kitchens network. Each All Day Kitchens location (today in SF, Chicago, LA, and Dallas) serves food from dozens of these “local heroes,” and consumers can order through their favorite delivery app like DASH or UBER, or directly on Alldaykitchens.com. Users can add their favorite CPG products to orders, and even place multi-restaurant orders in the same cart. Ever feel like a bit of curry or dumplings with your burger, maybe with a bit of ice cream to finish? All Day Kitchens has got you covered!

All Day Kitchens has performed remarkably well, growing 4x YoY with industry leading profit margins and service levels. The average All Day Kitchens order arrives in 20 min — less than half of typical delivery times. Its newer locations are performing even better than its older ones, a sign of network effects from density of locations and restaurant partners, as well as growing operational sophistication. The company has built significant tech to operate locations remotely, an essential element for fast and profitable new market entry.

All Day Kitchens marks Lightspeed’s 12th global investment at the intersection of food and commerce across the US, Europe, India, China, Southeast Asia, and LATAM:

We are thrilled to partner with Ken and Matt on their journey to help the best local restaurants operate at internet scale and delight their customers with tasty, satisfying cuisine. We are grateful to work alongside friends and co-investors, Andrew Chen at Andreessen Horowitz, Keith Rabois at Founders Fund, Adeyemi Ajao at Base10, and Jeremy Kranz at GIC, all of whom are investing in this round.

All Day Kitchens is hiring aggressively to hit some ambitious goals. If you’re excited about using technology to scale restaurants and want to get on a rocket ship, check out the job listings page: https://apply.workable.com/all-day-kitchens/

Tweet of the Week

Enjoyed this newsletter?

Getting Drinking from the Firehose in your inbox via Substack is easy. Click below to subscribe:

Have some thoughts? Leave me a comment:

Or share this post on social media to get the word out:

Disclaimer: * indicates a Lightspeed portfolio company, or other company in which I have economic interest. I also have economic interest in a number of public equities, including, but not limited to AAPL, ABNB, ADBE, AMT, AMZN, BLK, CCI, CRWD, FB, GOOG/L, HD, MA, MCD, MELI, MSFT, NEE, NET, NFLX, NOW, NVDA, PYPL, SE, SHOP, SNAP, SNOW, SPOT, SQ, TMO, TWLO, TXG, V, and VEEV. (Last updated: 10/3/2021)