One Big Thought

How big can a single brand be?

Here’s one data point — for about a week this May, the richest person in the world wasn’t a tech magnate like Bezos or Zuckerberg. It was Bernard Arnault, the majority shareholder in LVMH, the parent company of luxury brands like Dior, Louis Vuitton, and Tiffany. LVMH has a market cap over €320B and produces around €50B in annual revenue across 75 premium brands. Fashion & leather goods are 47% of revenue, while wines & spirits and perfumes & cosmetics make up 11-12% of revenue each. The remainder is comprised of watches & jewelry, as well as other non-branded activities like retail and publishing.

LVMH doesn’t disclose the revenue of individual brands. However, if we remove the retailing, publishing, and hospitality revenue, we get around €40B, or ~€500M per brand on average. At current exchange rates, that’s $600M+ per brand. The leading brands in its portfolio almost certainly produce over $1B in annual sales each. For example, Louis Vuitton, which was founded in 1854 (!), is estimated to produce over $15B of revenues at over 30% profit margins. Even at a conservative 10x EBITDA multiple, Louis Vuitton should be worth over $45B with that kind of performance. Despite its scale, only ~10% of LVMH sales come through e-commerce. Even in 2021, the world’s leading luxury brands are predominately offline businesses.

Newer brands have accumulated similar revenue and value over an even shorter period of time. One secret is owning their own distribution — first retail, then e-commerce. Founded in 1964, Nike (NKE) produced $39B of LTM revenues and is worth $215B today in market cap. 35% of its revenue, or $13B, was sold through its own website. Founded in 1998, Lululemon (LULU) produced $4.4B of LTM revenues and is worth around $51B today in market cap. 52% of its revenue is DTC and 38% comes through its own network of retail stores. Founded in 2006, Yeti (YETI) produced $1.1B of LTM revenues and is worth around $7.6B today in market cap. 53% of its revenue is DTC, and that segment is growing faster than wholesale.

The trendline suggests that $1B+ revenue brands are becoming more common and are scaling revenue faster. The one common characteristic of those who reach scale is a high percentage of e-commerce sales. As articulated by Andy Dunn of Bonobos* years ago, the digitally native vertical brand (DNVB) thesis relies on a direct relationship with an end customer to accelerate the discovery and continual optimization of product/market fit. The flywheel of building brand love simply spins faster with online transactions. As such, these brands can get to $1B+ of revenue faster than their offline predecessors.

DNVBs have finally started to go public. Founded in 2014, Casper (CSPR) had its IPO in early 2020 and is currently worth $389M in market cap on close to $500M in trailing revenues — not exactly stellar performance. In Firehose #154, I wrote about some of the problems with Casper’s strategic choices prior to its IPO. However, we should also note that its direct competitor Purple (PRPL) is worth $1.9B on nearly $650M of revenues. So, the mattress-in-a-box business actually works, just not for CSPR unfortunately.

A similar dynamic played out in the meal kit space with Blue Apron (APRN) and Hello Fresh (HFG). The former was the pioneer of the model, but the latter got the implementation right. APRN is now worth only $90M in market cap on $488M of revenues, while HFG is worth $16B on $5.2B of revenues. It crossed $1B in revenues in its first 5 years, and $5B in revenues in a decade — a record for a DNVB. In addition, The Honest Company (HNST, a Lightspeed portfolio company)* had its IPO last month and is currently worth $1.4B in market cap. It disclosed over $300M in revenues in the last fiscal year. We discussed its path to IPO in my partner Jeremy Liew’s blog post here.

All these companies were built on custom technology platforms. The newest cohort of companies are building on 3rd party e-commerce platforms instead. For example, medical apparel company Figs (FIGS) IPO’d last week with remarkable success. FIGS is itself a business that few people “got” at the beginning; yet, it clearly serves an under-appreciated niche extremely well. This statement in the company’s S-1 stood out to me:

Our mission is to celebrate, empower and serve those who serve others.

Who does that sound like? I’ll give you a hint.

In Jobs’s incredible speech upon his return to Apple in 1997, the Apple founder talked about how he was rearchitecting the company’s marketing strategy:

To me, marketing is about values. This is a very noisy world. And we’re not going to get a chance to get people to remember much about us. No company is. And so we have to be really clear about what we want them to know about us….

One of the greatest jobs of marketing that the universe has ever seen is Nike. Remember — Nike sells a commodity; they sell shoes. And yet when you think of Nike you feel something different than a shoe company. In their ads, they never talk about the products. They don’t tell you about their air soles and why they’re different from Reebok’s air soles.

What does Nike do in their ads? They honor great athletes, and they honor great athletics. That’s who they are; that’s what they’re about.

In honoring those who serve others, FIGS is carving out a unique space for consumer brand values and claiming it as their own. They also are the first company to go public explicitly with the DNVB moniker front and center. Again, from its S-1:

We Are a Digitally Native Direct-to-Consumer Brand.

We are a digitally native DTC brand that utilizes technology to deliver a differentiated customer experience. We disrupted the industry’s historical distribution model, which required healthcare professionals to physically travel to brick-and-mortar stores to purchase their uniforms. We have built the largest DTC platform in healthcare apparel, leading the industry in the shift to digital. By selling directly through our digital platform, we control all aspects of the customer experience. Further, we are able to engage with our community of healthcare professionals before, during and after purchase, through our digital platform and numerous other channels. This direct engagement enables us to establish personal relationships at scale and provides us with valuable customer data and feedback that we leverage across our organization to better serve our community.

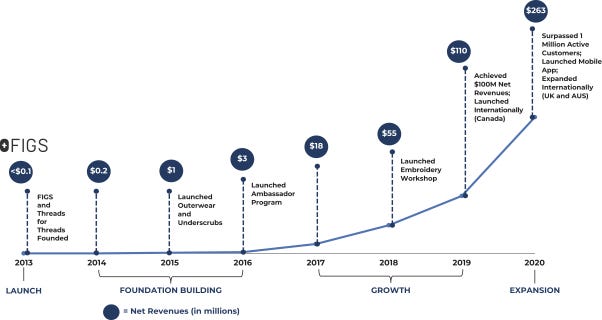

FIGS has grown over 100% annually since 2016, with over $260M revenue in 2020. FIGS took a while to find its groove, but really took off in 2017:

The company’s gross margins are over 70%, with 28% adjusted EBITDA margins. It has simultaneously increased LTV and lowered CAC over time — although COVID likely had something to do with falling CAC in 2020. Cohort retention is very strong for an apparel business, likely due to the non-discretionary nature of the category.

FIGS is currently worth around $5B on its $318M of trailing revenues and $57M of trailing net income (~100x P/E). Much of that value was created in the last 5 years. If we started the clock 5 years ago, it’s possible FIGS could be the fastest DNVB to $1B in revenues. If so, what enabled it to move so quickly?

One anomalous factor could be that FIGS is the first public DNVB to build on a 3rd party e-commerce platform. The Shopify* CEO Tobi Lutke himself pointed this out on Twitter this week:

When Tobi said his goal was to “arm the rebels,” most of us assumed that the rebels would all be individually tiny. But, what if that assumption is false? What if building on a 3rd party platform like Shopify actually increases your odds of building a $1B revenue brand? Will we see DNVBs grow even faster to $1B+ in revenues because of the infrastructure Shopify and its competitors/partners provide?

My view is that it’s become so much easier to build iconic brands with these tools, and that many of those brands will start online with platforms like Shopify. They’ll also be able to access retail at scale much more easily thanks to wholesale platforms like Faire.* Omni-channel omnipresence is within the reach of the youngest companies now. With digital platforms, it shouldn’t be surprising to us that the some of the “rebels” are now themselves multi-billion dollar companies in record time.

Tweet of the Week

Enjoyed this newsletter?

Getting Drinking from the Firehose in your inbox via Substack is easy. Click below to subscribe:

Have some thoughts? Leave me a comment:

Or share this post on social media to get the word out:

Disclaimer: * indicates a Lightspeed portfolio company, or other company in which I have economic interest. I also have economic interest in AAPL, ABNB, ADBE, ADSK, AMT, AMZN, BABA, BRK, BLK, CCI, COUP, CRM, CRWD, GOOG/GOOGL, FB, HD, LMT, MA, MCD, MELI, MSFT, NFLX, NSRGY, NEE, NET, NFLX, NOW, NVDA, PINS, PYPL, SE, SHOP, SNAP, SPOT, SQ, TMO, TWLO, VEEV, and V.

Just wanted to say that this was a delightful read!

Deepak, Mumbai

Great article! Lots to think about. Yeah, what happened to Casper? D2C the best way to get consumer feedback, but you have have something in place to hear the feedback and act on it quickly. I watched a story about the Costco CEO that spent nearly all his time traveling to different stores, walking around and getting feedback. I agree with you (and Mr. Jobs) that the majority of consumers want to connect brands to a big idea rather than tech details. But, but you can do it the other way too. Google won with great tech. They won over the geeks and the geeks explained it to their families and non-geek friends. That probably takes longer and requires a significant tech advantage. It is also important to remember that when it is at its best, Apple has both a big brand and top tech - a great combination! We have great tech and the makings of a great brand, but, after reading this, I think we need to focus more effort on pitching that big idea that consumers can connect our brand with.