Drinking from the Firehose #122: 😋 Food for thought 😋

69% of American household spending breaks down into just four categories: housing/utilities (27% of spend), transportation (18%), food (15%), and healthcare (9%). These categories are either dominated by services already, or are shifting quickly in that direction.

The percentage of Americans who rent a home is approaching a 50-year high of 37%. Rental payments approximate $500 billion annually in the U.S. alone. With the success of Uber, Lyft, and a variety of other ride-hailing networks globally, miles driven is shifting rapidly towards service models. Uber estimated that 7.5 trillion passenger miles worth $4.7 trillion globally constitute its target market, of which it only captured "only" $50 billion (~1%) in 2018. Healthcare, for 90%+ of Americans, is purchased a service from a combination of providers and payors, who collect $868 billion in premiums annually.

Food consumption is over $2 trillion in the US alone, which makes it bigger than all these categories, with the exception of transportation. The first iteration of "food as a service" (FaaS) was the humble restaurant. According to Wikipedia, the first restaurant opened its doors in Paris around the time of the French Revolution. In the U.S., restaurants first became popular in the West during the Gold Rush, but until the mid-1900's eating outside the home wasn't that affordable or popular. When an American entrepreneur named Ray Kroc took over McDonald's in the late 1950's, he ushered in a new era of "fast food." The processes he pioneered drove McDonald's to success and made consistent and cheap restaurant food available nationwide. While restaurants have shifted food offerings in recent decades towards more healthy and fresh ingredients, the 650,000 U.S. restaurants (and millions globally) still operate from a 1950's playbook.

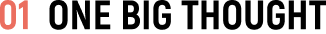

Food still has a long way to becoming a true service like the ones we consume when we rent a house, order an Uber, or walk into the doctor's office. ARK Invest recently broke down the food delivery market and identified $3 trillion of global opportunity in FaaS. The paper flags the rise of "eating out" relative to food at home as a market driver, but eating out has its own set of problems: expense, inconvenience, and lack of consistency. ARK rightfully argues that restaurant ordering aggregators like Grubhub (US), Meituan (China), and Just Eat (Europe) remove these friction points. It also suggests future innovations like subscription, so-called dark kitchens, and kitchen automation that will drive the trend even further.

I am tempted to extend ARK's analysis to the $760 billion food CPG sector as well. Grocery stores are adopting services like Instacart and Shipt to deliver these products to customers' homes, but those platforms do not solve for the convenience of actual meal preparation. Dozens of meal kit companies promised to address this issue, but were challenged by capital intensive business models. More fitting would be a food CPG service like Daily Harvest, which turns your freezer into a customized pantry, stocked with non-perishable, frozen meals that are quickly prepared and replenished as they are consumed.

The continued shift towards a service economy in food that is digitally enabled will unlock attractive economics for market aggregators like these. Food is the next largest global opportunity after transportation, so the prize is indeed Uber-like in scale.

Food-as-a-Service: The $3 trillion meal delivery market

If 2.8 billion consumers in 2030 were to access meal delivery services once a week at an average cost of $7 per meal, the market would scale nearly 10-fold to roughly $1 trillion at an annual rate, as shown above. If adoption were to hit 3 meals per week, the market size could reach $3 trillion. Interestingly, Meituan users already order through the service more than three times a week, suggesting that our estimates could be much too conservative. In other words, at an implied penetration of just 4% today, the $120 billion global meal delivery market is nascent relative to its long-term opportunity.

#commerce

Fiverr, HQ'd in Tel Aviv, is building a platform for the gig economy and filed its F-1 to go public this week. It disclosed 5.5 million cumulative buyers, of which 2.1 million were active in the last year. It positions itself as a broad horizontal platform, offering jobs in "digital services" from over 200 categories.

The business showed $83 million in trailing revenue, a 25% take rate, and 79% gross margins. In Q1-2019, Fiverr grew 43% y/y. Active buyers, however, are only growing 10% y/y, while spend/buyer is growing 19% y/y. Note: spend/buyer is up 2x since 2014 thanks to the success of the Fiverr pro program.

I was delighted to see Fiverr disclose cohort data going all the way back to its founding in 2010. Recent cohorts have unfortunately seen higher first year churn, likely due to increased prices. Paybacks on marketing costs are solid in the 7 month range. 2-year LTV/CAC looks like 2.0x on a gross margin basis. Presumably Fiverr spends little to acquire sellers because it doesn't disclose those numbers.

The business will likely be comp'd against Upwork (UPWK, 6x trailing revs) and a broader basket of marketplace businesses which trade in a similar range. That would value Fiverr at less than a billion of enterprise value, which would make its IPO rare in the context of other businesses which are going public at greater scale. If it trades nicely, Fiverr could be a bellwether for smaller IPOs.

#media

As Mark Zuckerberg pushes Facebook to become a platform for more intimate sharing and conversation, the Groups feature is becoming more prominent. More than 400 million of Facebook's 2.4 billion MAUs are members of at least one group.

This week Taylor Lorenz pointed out that the run-of-the-mill groups that Mark wants to emphasize (book clubs, mommy meet up's, etc) aren't necessarily the most popular ones. So-called "tag groups" have become very popular. Because Facebook enables groups to be tagged like individuals in comments and posts, groups with names that sound like statements (e.g. "I went to hell for laughing at this.") get a viral push when they flow into your comment stream. The content of these tag groups is usually a stream of memes that relate to the topic. Meta tag groups (i.e. tag groups of tag groups) even exist as a discovery mechanism.

#tech

Deepfakes aren't just for videos and images. AI researchers have trained their algorithms on none other than champion podcaster Joe Rogan. The completely fake audio you hear in the recording isn't perfect, but if you heard an episode of The Fake Joe Rogan Experience my guess is you wouldn't know the difference.

#science

Biologists have created an E. Coli bacterium with a completely synthetic genome. They switched a few of the organism's codons and with different ones that created the same proteins. In the future, these codons could be replaced with new material that codes for completely novel proteins.

#culture

A single test cannot measure the true aptitude of a student. Life gets in the way. Students are born into various socioeconomic circumstances, and tests like the SAT and ACT do little to correct for them. It is, for instance, widely known that a student's race correlates with his or her test score. The College Board has therefore recently rolled out an "adversity score," which is meant to unskew the SAT/ACT to account for a student's background. For example, the adversity score takes into account data on neighborhood (e.g. crime, poverty), family (e.g. income, parental status), and high school environment (e.g. free lunch rate, AP opportunity).